Should Self Storage Operators Worry About a Looming Recession?

As we near the end of 2025, the economic horizon looks anything but calm. Headlines echo with warnings of rising prices, whispers of recession, and a Federal Reserve that appears to move cautiously.

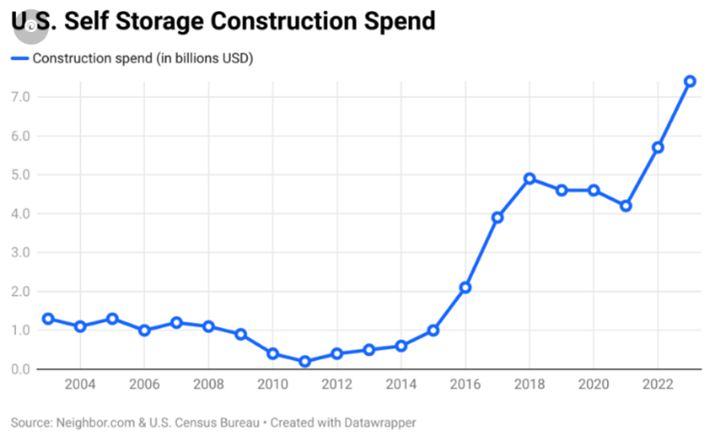

Across the country, business owners are bracing for impact, watching the dollar fluctuate and interest rates holding firmly high even with the recent .25% decrease. In this turbulent economic environment, self-storage operators are at a crossroads. Vacancy rates are creeping upward in some areas of the country, rental rates are softening, leaving owners and operators wondering if a once-reliable stream of revenue is drying up, and if so, for how long.

At a glance, the outlook may seem grim, but with economic uncertainty comes opportunity. In this blog, we’ll explore the economic factors shaping the industry and strategies that can help your operation thrive in the face of a potential recession.

Is the U.S. in a Recession?

The word “recession” is often used loosely, but it is officially defined by the National Bureau of Economic Research (NBER) as “a significant decline in economic activity that is widespread across the economy and that lasts more than a few months.” Right now, experts have not declared the United States to be in an official recession, but are keeping an eye on key indicators such as:

Interest Rates - Lower rates create a more favorable borrowing environment for businesses, encouraging investment, expansion, and new development initiatives.

Inflation - As of August 2025, inflation is moderately high, with the Consumer Price Index (CPI) showing a 2.9% year-over-year increase, pushing operators to try to increase rates while possible tenants are reexamining their own finances.

Supply Chain - Nationwide, businesses are struggling with increased operating costs, inventory concerns, and project delays that are negatively impacting their overall financial performance and putting pressure on all businesses.

Housing Market - Since a large majority of tenants are families and individuals relocating from one home to another, the slowdown in available homes on the market, coupled with inflated prices, has pushed the home-buying dream further out of reach for many.

Recession Resistant?

In general, veteran operators advise not to worry since self-storage has historically been a “recession-resistant” industry. Self-storage facilities have lower operating costs and flexible rental rates, enabling operators to respond quickly to economic events and attract both investors and customers during periods of financial uncertainty. Some even argue that economic downturns create a greater need for storage as people downsize living spaces, relocate for work, or close businesses.

To evaluate how self-storage may react if we indeed enter a recession, we should examine the most recent examples of economic downturns, the 2008 Great Recession, and the recession caused by the Pandemic. Different drivers caused both events, and while there is no recent example of how tariff-induced recessions have impacted self-storage, let’s look at how self-storage weathered these two most recent downturns:

2008 Great Recession

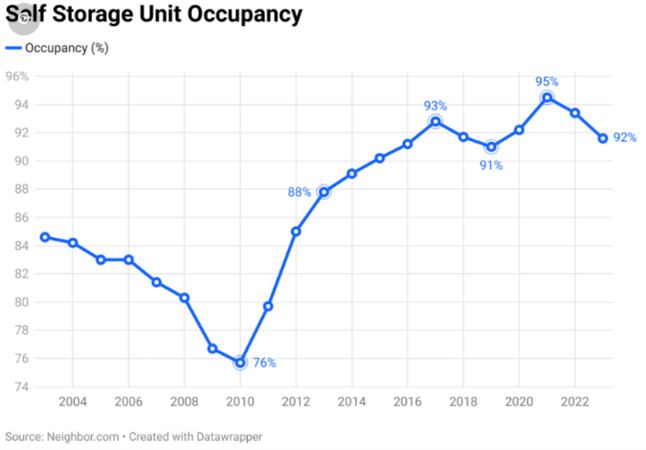

During the 2008 financial crisis, self-storage stood out as one of the few commercial real estate sectors to get away relatively unscathed, keeping occupancy rates high and rental rates stable. While most segments experienced revenue net losses ranging from 25% to 67%, self-storage had a net gain of 5%, according to Mainstay Global. This resilience wasn’t coincidental; it was rooted in the nature of the crisis, which was deeply tied to the housing market. As foreclosures surged and homeowners were forced to downsize or relocate, many turned to self-storage as a temporary solution.

COVID-19 Recession

Fast forward to the COVID-19 pandemic, and the story repeats itself, albeit under very different circumstances. Despite widespread economic turmoil, the self-storage industry not only remained stable but also thrived. U.S. Census Bureau data shows that the revenue for self-storage operators increased from 2019 to 2021, with Net Operating Income (NOI) rising by 1.9%. Facilities across the country reported record-high occupancy rates, with some reaching 95%.

The common thread of both economic crises is this: when people face uncertainty, they seek flexibility. Self-storage provides just that: a low-cost, low-commitment way to adapt to change, whether financial hardship, housing transitions, or lifestyle adjustments drive it.

How Can Operators Prepare?

There are proactive steps operators can take to strengthen their operations and anticipate shifts in demand amidst economic uncertainty.

Operational Readiness

Operators should prioritize building strong supplier relationships, treating vendors as strategic allies. This involves collaborating to forecast demand, understand production timelines, and identify potential bottlenecks. By doing so, operators can anticipate delays and secure inventory in advance, especially for facility maintenance and upgrades. Additionally, operators should take advantage of manufacturer promotions and limited-time deals to significantly reduce costs, especially while suppliers are absorbing the costs of tariffs. As tariff policies evolve, manufacturers will likely begin passing on a greater portion of these costs to buyers, and the financial burden of upgrading facilities will increase. Delaying improvements could result in higher costs and longer lead times, compromising operational efficiency and competitiveness.

Financial Flexibility

Take the time to review your pricing models. With rental rates declining slowly, consider implementing dynamic pricing tools or promotions to attract and retain tenants. Also, keep a close eye on operating expenses and identify potential areas for cuts to ensure stability during slower periods.

If and when there is pressure on cash flow, automation will be the one thing that keeps a facility not only running, but profitable. Those facilities that have waited on the sidelines and have not embraced automation may now be forced to or risk being sidelined completely.

Remember - automation is a solution for the short, medium, and long term. To put it simply, even if the economy does not slide into a full recession, investments made for increased automation will pay dividends throughout any economic climate.

Market Awareness

Operators should stay informed on the local housing market and interest rates, as more homes are popping up on the market and lowering asking prices. Recognize that a period of economic downturn presents a unique demand for storage as people are relocating, downsizing, and closing businesses. And while not all tenants fall into the category of individuals or families transitioning from one house to another, it is a sizable percentage of tenants. All things being equal, the more active the housing market is, the greater the need for self-storage.

Falling interest rates will not only incentivize consumers to think about finally purchasing that home they have their eye on, but will also free up capital and projects that were put on hold waiting for rates to drop back down. This may also allow some self-storage operations to think about injecting more capital into their current operations for increased automation and greater profit margins. Doing so also makes these facilities more competitive with the larger REITs or new construction projects, which may have just been pushed forward because of the lower rates.

Key Takeaways

While the possibility of a recession still looms, self-storage operators should take comfort in the fact that challenges of high interest rates, rising inflation, supply chain difficulties, and a gridlocked housing market may seem daunting, but they present opportunities for operators to pivot. Is self-storage recession-proof? Probably not, but based on historical data, one could argue that self-storage is at least recession-resilient. And by focusing on operational readiness, financial flexibility, and keeping up with market conditions, your facility can not only survive but thrive.